Oct 14, 2025

Introduction

A leading microfinance and lending institution needed to modernize its loan origination systems to support rapid growth, reduce processing delays, and strengthen credit risk controls across regions. Legacy systems lacked the scalability, data unification, and automation required to efficiently onboard borrowers and evaluate loan applications with accuracy.

Zapcom delivered a modernized, data-driven loan origination platform powered by a consolidated data lake, machine learning–based credit models, and API-first architecture. This transformation enabled the lender to accelerate approvals, enhance compliance, and reduce operational friction across its end-to-end borrowing lifecycle.

Problem Statement

The lender faced significant challenges due to fragmented borrower data, manual credit evaluation workflows, and prolonged underwriting cycles driven by legacy systems that were not designed to ingest and normalize multi-regional data, perform real-time credit assessments, or integrate seamlessly with digital and partner ecosystems. These limitations led to higher operational costs, reduced scalability and availability, and slower time-to-decision. The organization needed a secure, cloud-ready, and modular loan origination platform to unify disparate data sources, automate credit scoring, modernize end-to-end loan workflows, reduce Total Cost of Ownership (TCO), enable rapid partner integration, and ensure full compliance with regulatory and financial standards.

Manual dependency across borrower onboarding and underwriting.

Siloed data sources across regions.

Limited accuracy in traditional loan-approval models.

Legacy infrastructure unable to support new digital loan journeys.

Designed and implemented a centralized microfinance data lake aggregating borrower and financial data across regions.

Built machine-learning prediction models to assess borrower risk and loan eligibility.

Modernized the loan origination system using API-first architecture.

Enabled automated ingestion pipelines with validation, cleansing, and monitoring controls.

Streamlined end-to-end loan workflows across intake, scoring, verification, and approval.

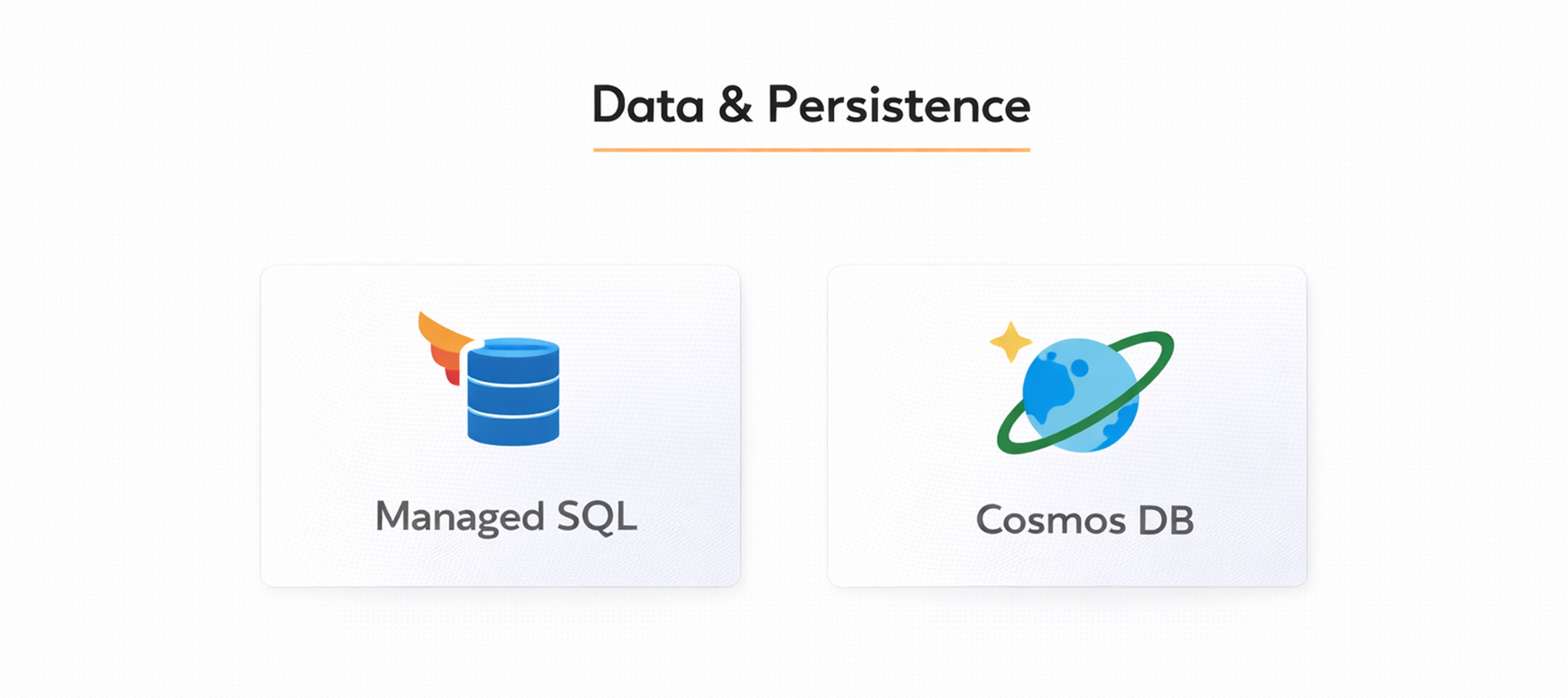

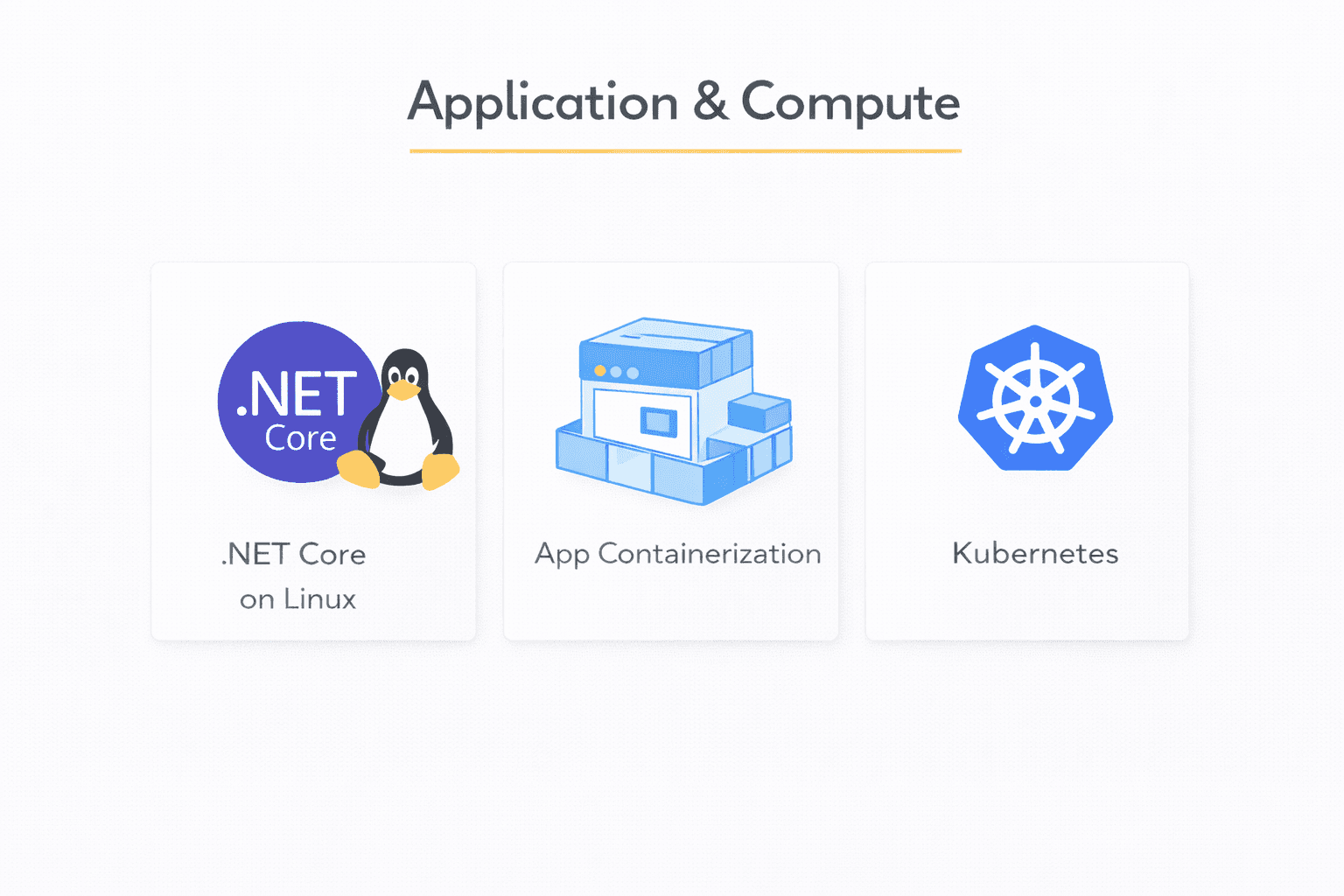

Technological Framework:

Why this setup?

Ensures strong transactional consistency for core financial data while enabling scalable, low-latency access for high-volume and distributed workloads.

Why this setup?

Delivers cloud-native, resilient microservices with horizontal scalability, high availability, and efficient resource utilization for business-critical services.

Why this setup?

Provides secure, governed, and scalable API exposure, enabling seamless integration with partners, channels, and external ecosystems.

Why this setup?

Enables infrastructure automation and secure CI/CD pipelines, ensuring consistent environments, faster releases, and enterprise-grade compliance.

Takeaway

Zapcom enabled the lender to transition from legacy, manual loan processing systems to a scalable, intelligent, and API-driven origination platform. By unifying borrower data, deploying ML-driven scoring, and modernizing infrastructure, the organization strengthened risk management, accelerated approvals, and positioned itself for digital-first microfinance growth across global regions.

Business Outcomes

The modern loan origination platform increased operational efficiency, improved borrower experience, and delivered higher-quality credit decisions.