Oct 14, 2025

Introduction

A global investment bank required a highly accurate, large-scale forecasting system to optimize returns across deposits, securities, and loan products. With market volatility, shifting economic indicators, and regional performance variations impacting product behavior, the organization needed a modern predictive engine capable of adapting to real-world conditions while ensuring reliable, long-term financial modeling.

Zapcom delivered a scalable forecasting framework leveraging advanced statistical models and machine learning techniques tailored to each investment product segment. This enabled the bank to significantly improve forecasting precision, streamline operational workflows, and enhance decision-making across global markets.

Problem Statement

A global investment bank needed a highly accurate, large-scale forecasting system to optimize return on investment across deposits, securities, and loans while dynamically responding to economic shifts and regional performance.

Needed to forecast potential outlet churn for proactive planning

Required dynamic pricing by region to improve product margins

High dependency on validating models against real-world data

Frequent disruptions from Federal Reserve decisions and market volatility

Solutions

Unified business-critical data across global regions and verticals into one aggregated data store

Developed dedicated forecasting models for each product segment (deposits, loans, securities)

Embedded seasonality patterns and macroeconomic variables such as interest rate hikes

Applied machine learning and deep learning models based on product types for monthly and annual cash flow predictions

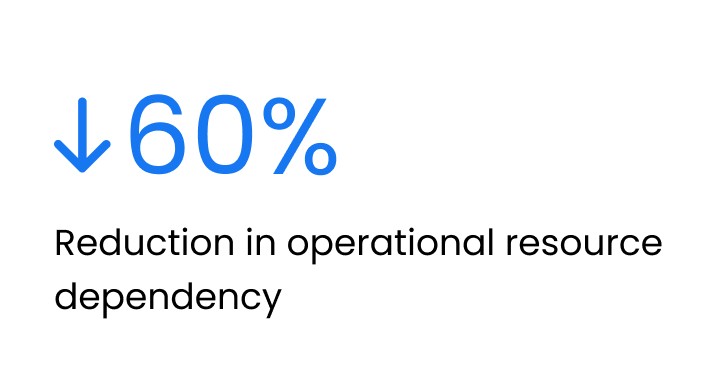

Business Outcomes

Technological Frameworks:

Statistical Forecasting Models:

Auto-regressive Integrated (AR)

Seasonal Auto-Regressive

ARIMA & SARIMA

Trigonometric Seasonality

Machine Learning & AI:

CATBoost

Gradient Boosting